Introduction

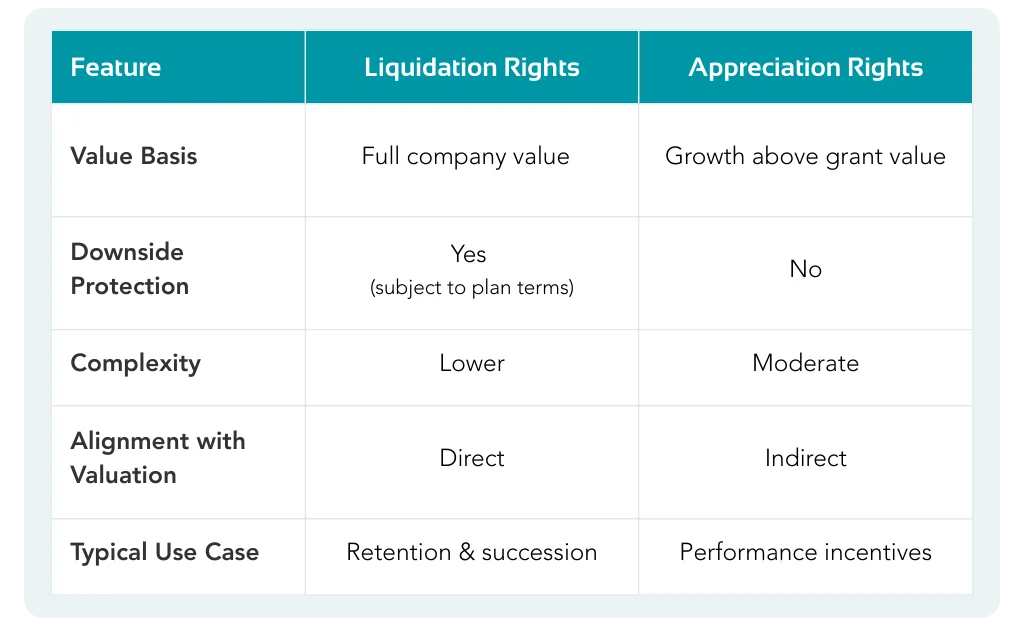

Phantom equity plans allow firms to reward and retain key team members by providing an economic interest in the business without transferring actual ownership. Two of the most common phantom equity structures are Liquidation Rights and Appreciation Rights. While both align incentives with firm value, they differ meaningfully in how value is measured, communicated, and paid.

Liquidation Rights (LR)

A Liquidation Right provides the participant with a contractual right to receive the full fair market value of a defined number of company shares upon a qualifying event (e.g., sale, retirement, termination without cause), subject to plan terms. In effect, it mirrors ownership economics tied to the company’s overall value at the time of the triggering event, rather than only rewarding value created after the award is granted. Because it is typically event-driven, it is commonly used to support long-term retention and alignment by linking meaningful upside to major transition or liquidity milestones.

How Value is Determined

- Each LR is denominated in shares or units

- Upon vesting, payout equals:

Key features

- Tracks total enterprise value, not just growth

- Uses a fixed share/unit count to determine per-share value

- Includes built-in anti-dilution and adjustment mechanics

- Paid in cash and treated as compensation (or equity shares, if permitted)

Best suited for

- Long-term reward and retention of senior leaders

- Succession and retirement-oriented incentives

- Firms seeking simplicity and alignment with entity-level valuation

Appreciation Rights (AR)

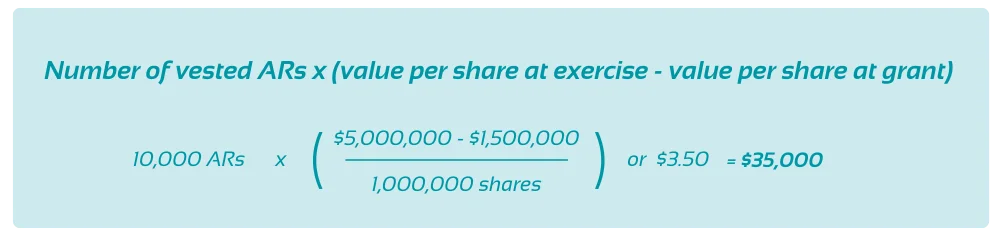

An Appreciation Right provides the participant with the increase in value of a defined number of units or shares between the grant date and the exercise date. It is designed to reward future growth above a baseline value established at grant, meaning the participant benefits only if the company’s value increases over time. This structure is often used to align incentives with performance and expansion, since payouts are directly tied to appreciation rather than total enterprise value.

How Value is Determined

- Grant date value is established upfront

- Upon vesting, payout equals:

Key features

- Rewards growth above a baseline value

- No payout if the company value does not increase

- Uses a fixed share/unit count to determine per-share value

- Can be more complex to track over time

- Paid in cash and treated as compensation (or equity shares, if permitted)

Best suited for

- Performance-driven incentives

- Growth-stage firms

- Shorter- to mid-term incentive horizons

Side-by-Side Comparison

Key Takeaway

Both Liquidation Rights and Appreciation Rights are powerful phantom equity tools—but they serve different strategic purposes. Liquidation Rights emphasize stability, clarity, and long-term alignment with enterprise value, while Appreciation Rights emphasize performance and upside growth. The right choice depends on your goals, timeline, and the role you want equity to play in motivating your team.